All About Clark Wealth Partners

Table of ContentsClark Wealth Partners Things To Know Before You Get ThisThe Facts About Clark Wealth Partners RevealedClark Wealth Partners - QuestionsFacts About Clark Wealth Partners RevealedClark Wealth Partners for BeginnersWhat Does Clark Wealth Partners Mean?Our Clark Wealth Partners Diaries

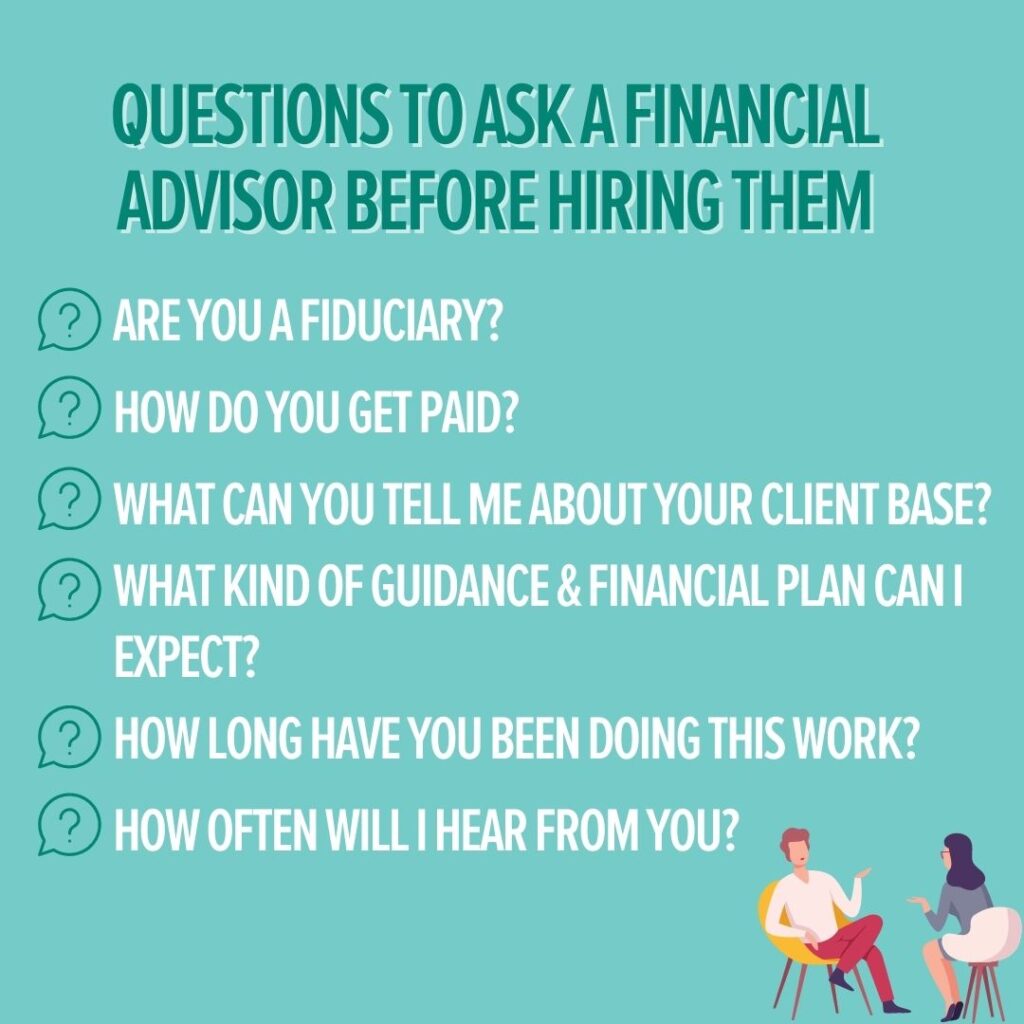

These are experts that offer financial investment advice and are registered with the SEC or their state's safety and securities regulatory authority. Financial experts can additionally specialize, such as in trainee finances, elderly demands, taxes, insurance policy and various other elements of your funds.Just monetary experts whose classification requires a fiduciary dutylike licensed financial coordinators, for instancecan claim the same. This distinction additionally means that fiduciary and financial expert charge structures differ also.

Facts About Clark Wealth Partners Uncovered

If they are fee-only, they're a lot more most likely to be a fiduciary. Lots of credentials and classifications need a fiduciary task.

Selecting a fiduciary will ensure you aren't steered towards certain financial investments as a result of the payment they supply - financial advisors Ofallon illinois. With great deals of cash on the line, you might desire a financial specialist who is legally bound to utilize those funds thoroughly and just in your finest passions. Non-fiduciaries may suggest investment items that are best for their wallets and not your investing objectives

5 Easy Facts About Clark Wealth Partners Described

Read a lot more now on just how to keep your life and financial savings in equilibrium. Boost in savings the typical household saw that collaborated with a financial advisor for 15 years or more compared to a similar household without a financial expert. Source: Claude Montmarquette & Alexandre Prud'homme, 2020. "A lot more on the Worth of Financial Advisors," CIRANO Project News 2020rp-04, CIRANO.

Financial guidance can be beneficial at turning factors in your life. Like when you're starting a family, being retrenched, intending for retired life or taking care of an inheritance. When you meet an adviser for the initial time, exercise what you want to obtain from the advice. Before they make any kind of referrals, an adviser must put in the time to review what is essential to you.

All About Clark Wealth Partners

When you've concurred to go in advance, your monetary adviser will certainly prepare a monetary plan for you. You need to constantly feel comfortable with your advisor and their guidance.

Urge that you are alerted of all transactions, which you obtain all communication pertaining to the account. Your adviser may recommend a managed optional account (MDA) as a way of managing your investments. This includes signing an agreement (MDA agreement) so they can buy or sell investments without needing to get in touch with you.

The 6-Minute Rule for Clark Wealth Partners

Before you purchase an MDA, contrast the benefits to the prices and threats. To safeguard your cash: Do not offer your consultant power of attorney. Never sign a blank document. Put a time limitation on any type of authority you offer to buy and market investments in your place. Urge all communication about your financial investments are sent to you, not simply your consultant.

If you're moving to a brand-new advisor, you'll require to arrange to transfer hop over to here your financial documents to them. If you require aid, ask your adviser to describe the process.

To load their shoes, the nation will certainly need even more than 100,000 new economic consultants to enter the sector.

Not known Facts About Clark Wealth Partners

Assisting people accomplish their financial goals is a financial consultant's key feature. They are additionally a tiny company proprietor, and a section of their time is committed to managing their branch workplace. As the leader of their method, Edward Jones economic experts need the management skills to employ and manage personnel, as well as business acumen to produce and execute a service method.

Financial experts invest time every day seeing or reading market information on tv, online, or in trade magazines. Financial experts with Edward Jones have the advantage of office study teams that assist them remain up to date on supply suggestions, mutual fund management, and a lot more. Spending is not a "set it and forget it" task.

Financial consultants should schedule time every week to fulfill brand-new people and overtake the people in their sphere. The monetary services industry is greatly regulated, and regulations transform frequently - https://244461241.hs-sites-na2.com/blog/how-financial-advisors-illinois-can-shape-your-financial-future. Numerous independent financial experts spend one to two hours a day on compliance tasks. Edward Jones monetary advisors are fortunate the office does the hefty lifting for them.

The 10-Minute Rule for Clark Wealth Partners

Continuing education is a required component of keeping a monetary consultant license (financial advisors Ofallon illinois). Edward Jones monetary advisors are urged to go after additional training to widen their understanding and skills. Dedication to education secured Edward Jones the No. 17 place on the 2024 Training pinnacle Honors checklist by Training magazine. It's also a good idea for monetary advisors to participate in industry meetings.